Overview

Gubong, historically the second largest gold mine in South Korea, represents a company making project. In Q2 2024, the Company signed a US$5m farm-out agreement providing a transformative free carry structure to advance the estimated 1.3Moz of high-grade gold into production. Through a JV, a local South Korean entity is managing and funding the development of the project to production with the Bluebird team providing technical advice on executing the project.

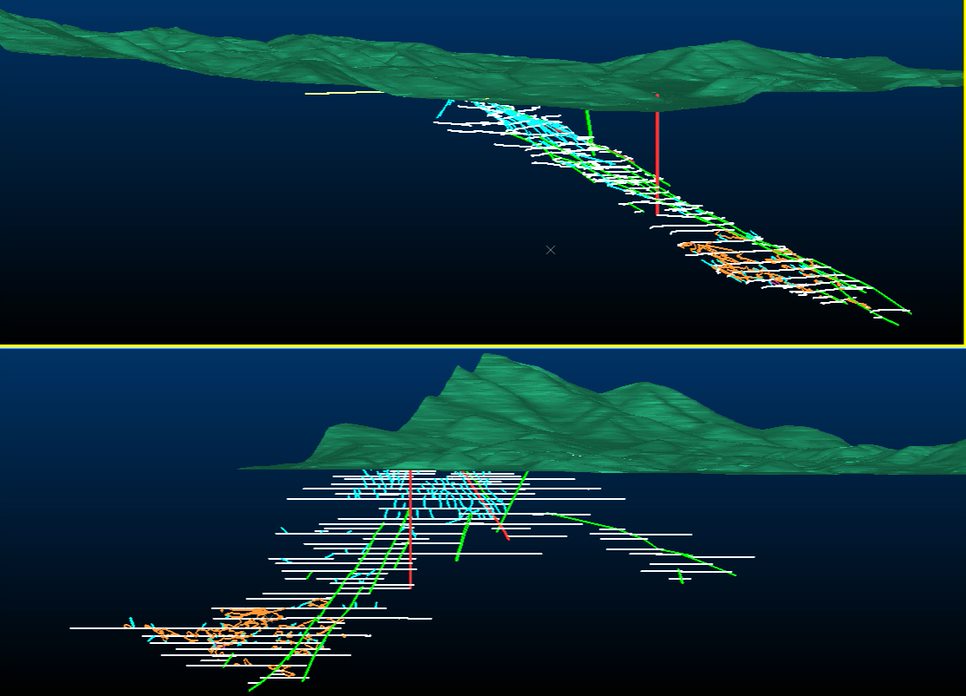

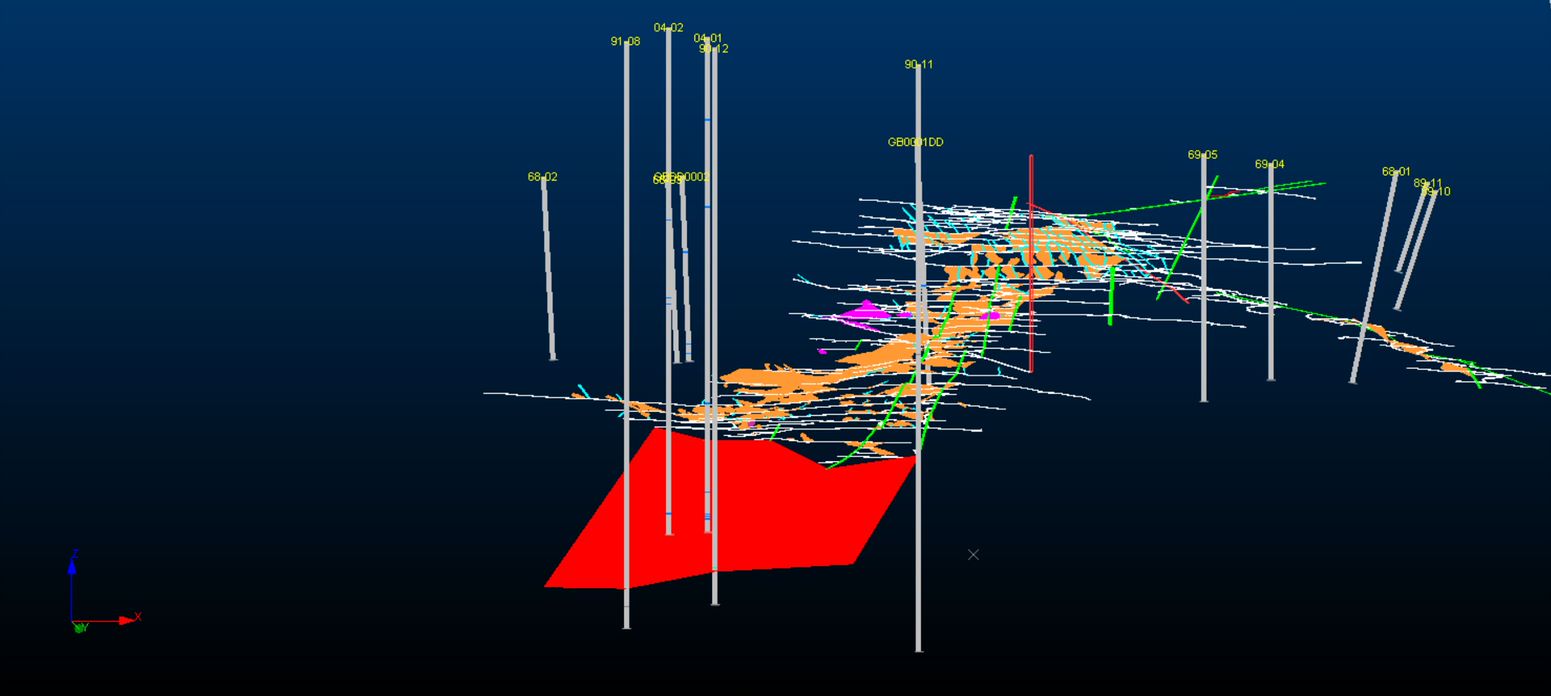

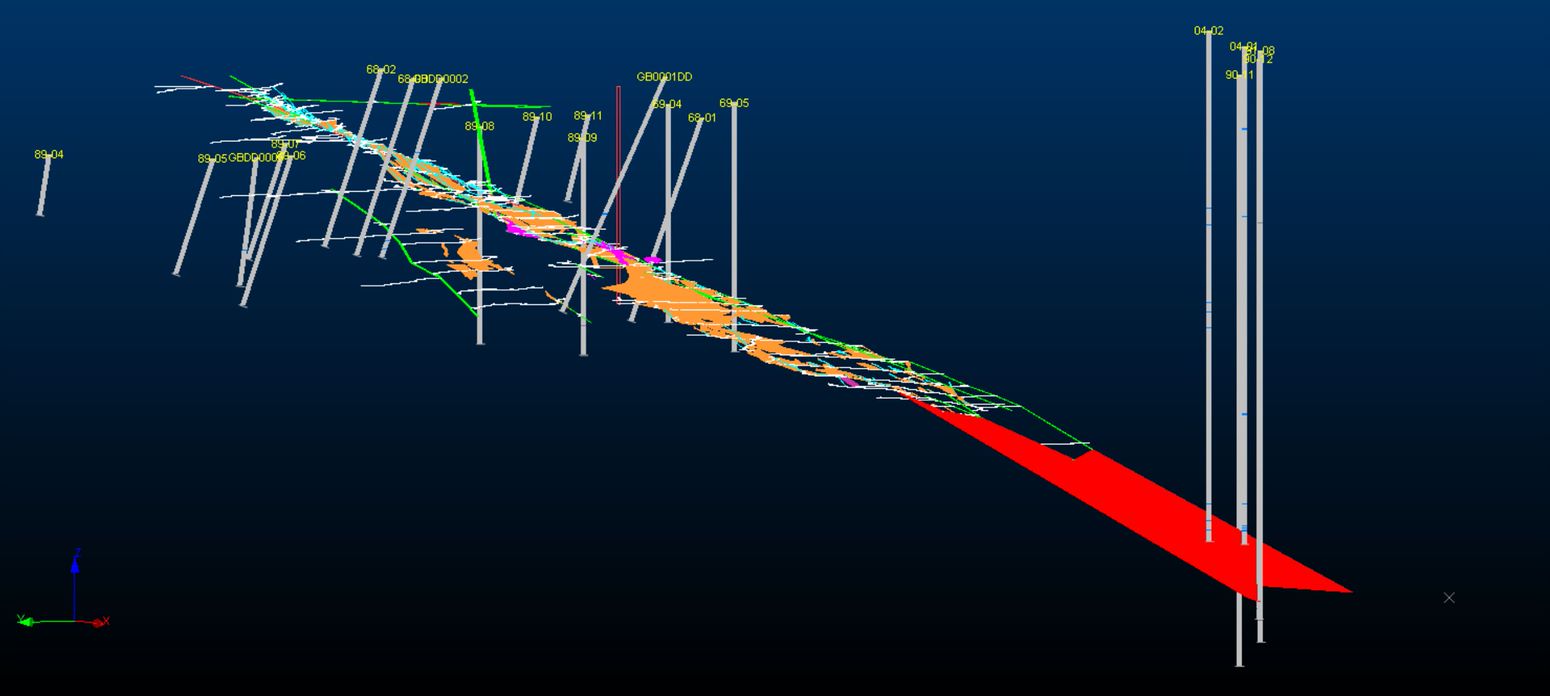

Both parties recognise the production opportunity at Gubong. Prior to looking at deepening the mine are the 25 levels already developed with all the remnants and unmined areas left by the original miners. These extend over 120 km which indicates the size of the opportunity. The Korea Resources Corporation (‘KORES’) estimated 2.34m tonnes at some 6 g/t Au garnered from 57 drill holes over 17,715.3m. Gubong is an orogenic deposit, which typically have a depth of 2km compared to the current depth of 500m. Production at Gubong in the medium-term target is c.60Koz Au with a long term potential of 100Koz per annum.

The Joint Venture Agreement

Gubong is being developed with a South Korean JV partner, which has agreed to invest up to US$5 million in return for a maximum 60% of the project. The Farm-out is over three stages with certain milestones needed to be achieved for the grant of equity in the JV. In the first and second stages, the JV will aim to obtain the relevant permits relating to bringing Gubong back into production (such as the Mountain Temporary Use Permit (MTUP)) and once received prepare a Development Report, which details the planned development of Gubong into production. In the third stage, the JV will execute this report and carry out other exploration and production related activities including but not limited to sampling, drilling, trenching, dewatering, permitting, mapping, surveys, technical studies (including the Development Report, environmental studies, acquiring land, feasibility studies and/or studies of resources and reserves) and governmental or local stakeholder liaison.

The JV provides Bluebird with a free carry to production at Gubong.

Rationale for Gubong

Mine studies, geological modelling, metallurgical testing, and previous data all point to the potential for a low capital intensity operation using simple process gravity separation or vat leach. With excellent infrastructure and a staged JV development structure, both parties recognise that the project represents an exciting opportunity to develop up to 100Koz Au production via implementing a low-risk development path.