Overview

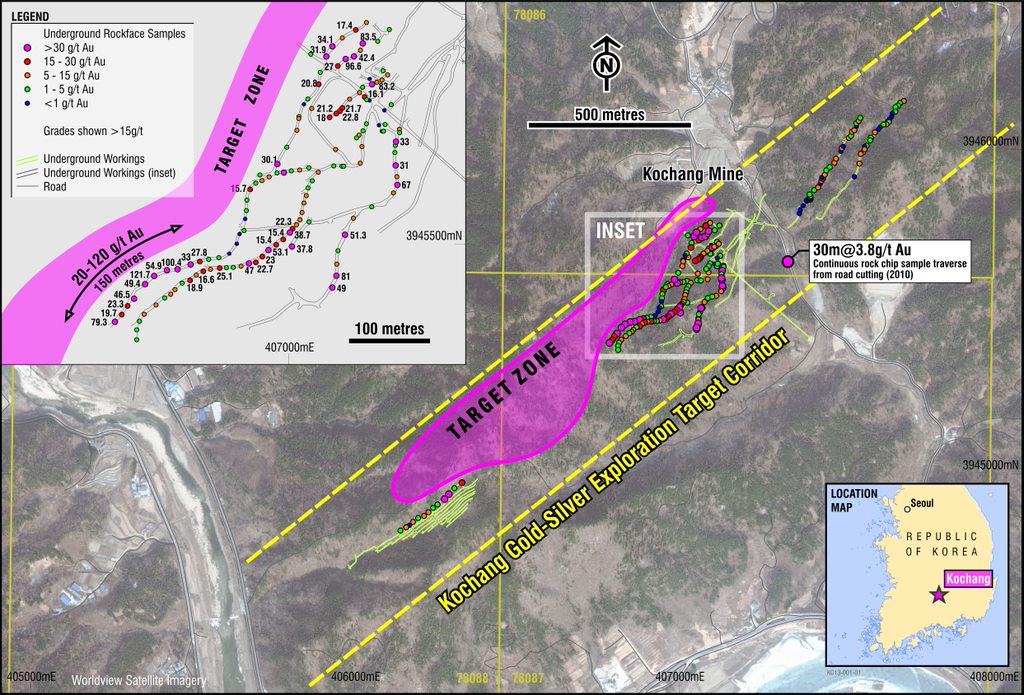

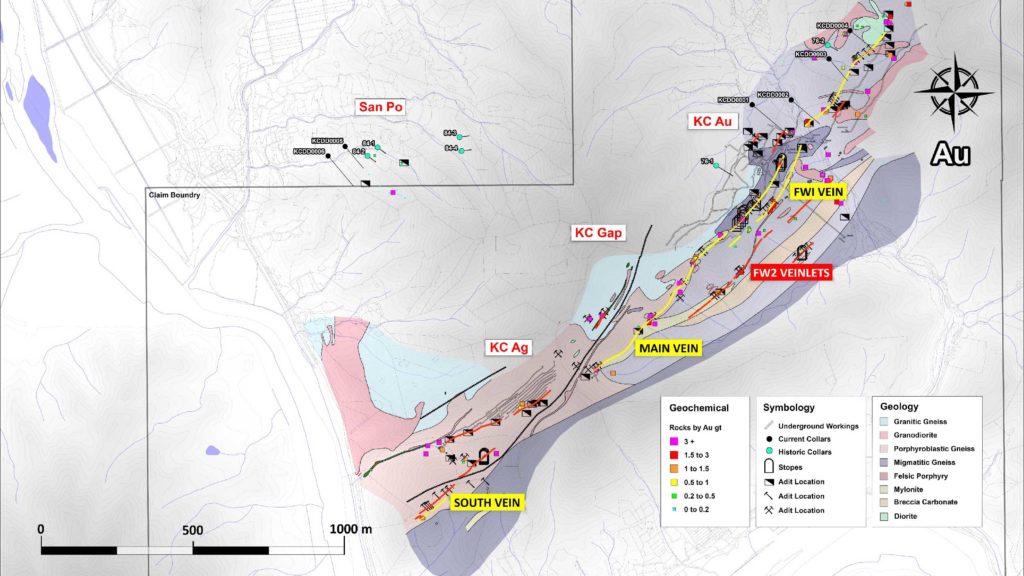

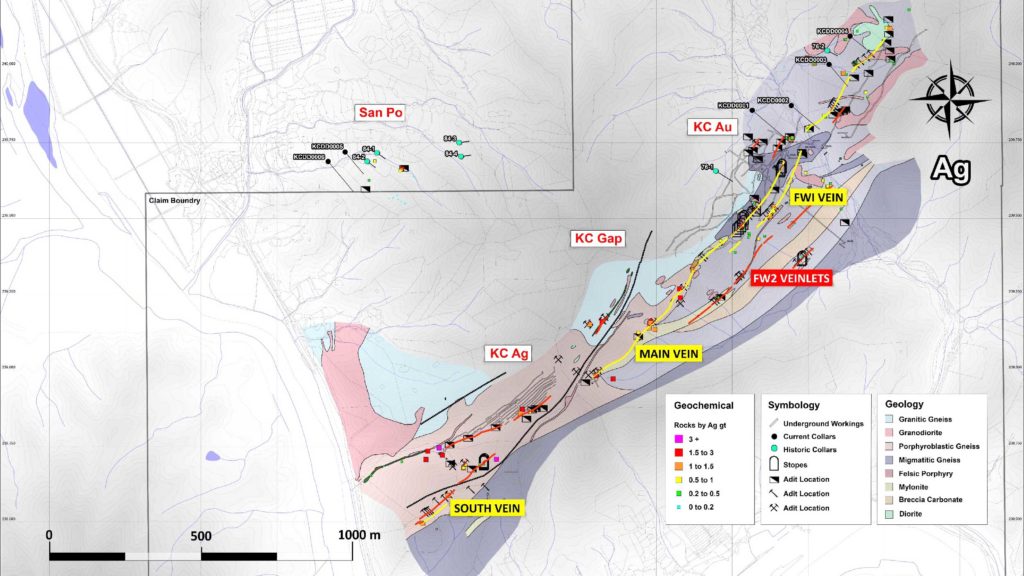

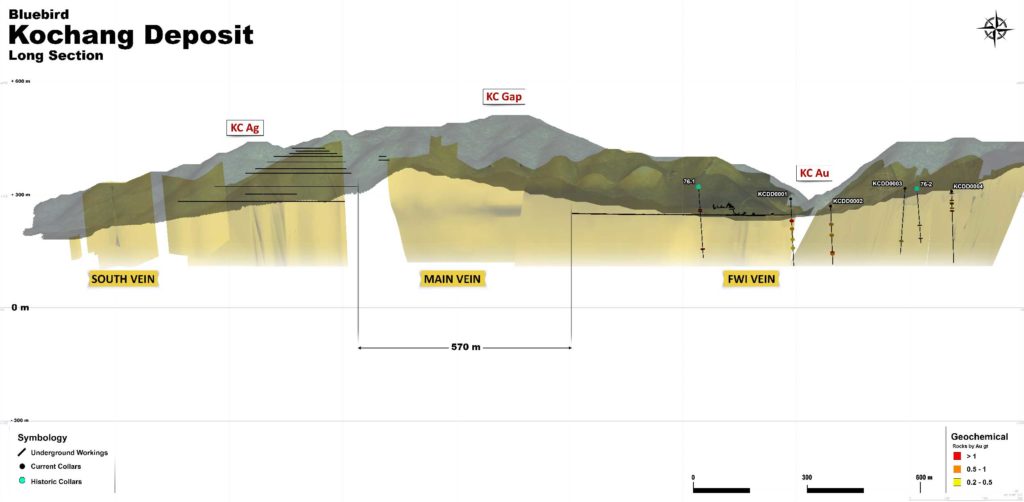

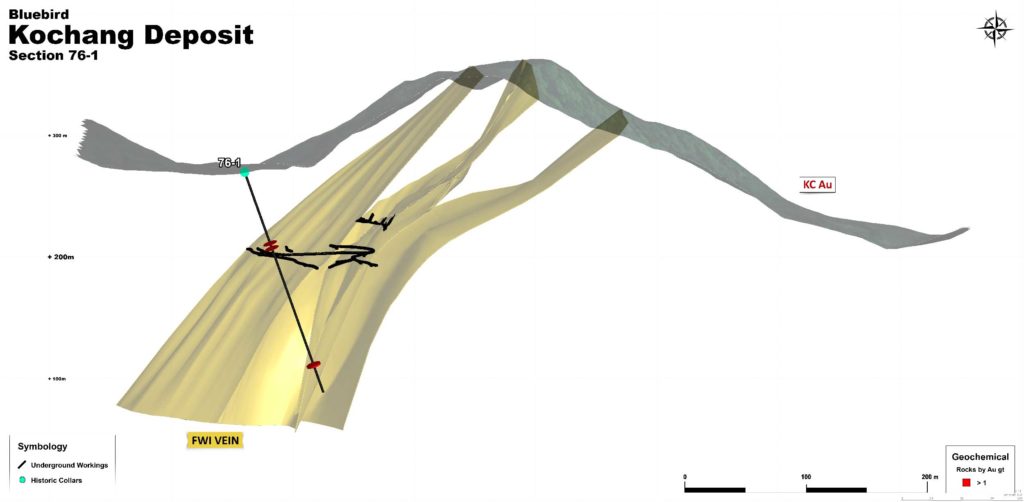

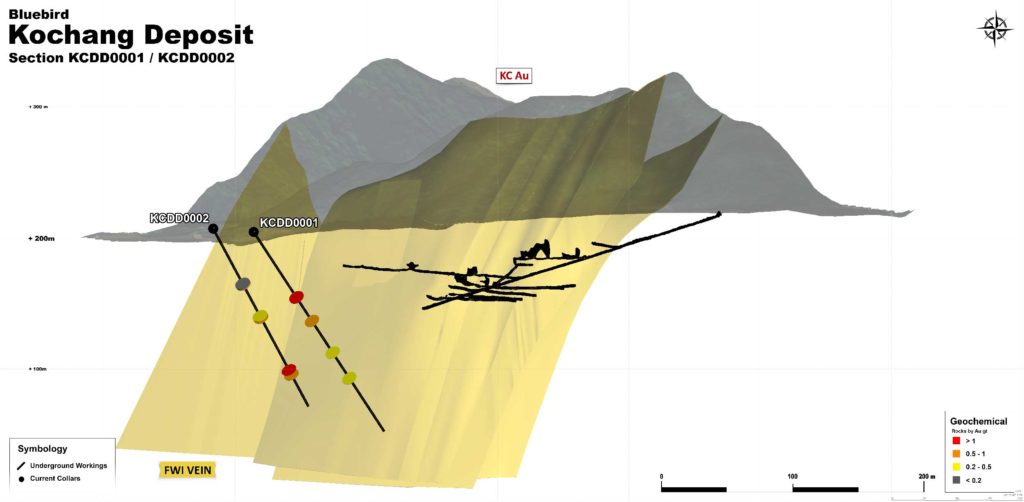

Kochang is an epithermal vein deposit with parallel vertical ore bodies covering 8.3 sq km that reportedly produced 110,000 oz of gold and 5.9 million oz of silver between 1961 and 1975. Consisting of a gold and silver mine, there are currently four main veins and a number of parallel subsidiary veins vein, which have been identified, as well as a newly identified cross-cutting vein. Historic drilling indicates the veins continue to depth below the current 250m mine and mapping shows the veins on surface providing potential above and below the old workings. The veins extend to the NE providing a strike length of 2.5km with 600m between the two mines not exploited. There is potential to expand operations to the southwest/northeast and to depth, as well as exploit the already mined areas.

Rationale for Kochang

Kochang is a relatively simple operation to reopen with excellent historic data, significant work already carried out, and a path to short term cashflow. The mine had good access, established infrastructure, is low Capex and offers high margin production potential.

Cashflow from Kochang will allow for an acceleration in production from Gubong